Late night talk show host, Jimmy Fallon, has a bit called, “Thank You Notes” – where he sarcastically shows appreciation for things that bother him.

Type 2 Diabetes definitely deserves its own Thank You Note:

Thank you, Type 2 Diabetes, for my nerve pain, irritability and blurred vision. I so appreciate all the money I get to spend on you. Above all, I really enjoy the medications you force me to take. – Sincerely, a Type 2 DiabeticAlmost 10% of the U.S. population could author that Thank You Note.

Sarcasm aside, we want to prevent type 2 diabetes from interfering with our lives as much we’re able to. That includes purchasing life insurance.

Here’s some good news – type 2 diabetics are approved for life insurance all the time.

There are some important facts (8 of them) you need to know in order to buy the best life insurance policy you qualify for at the lowest price:

Type 2 Diabetes In Numbers

8 Facts About Type 2 Diabetes And Life Insurance

Example Outcomes For Type 2 Diabetic Life Insurance Applicants

Bottom Line (and How To Apply)

Type 2 Diabetes In Numbers

Sources: Centers For Disease Control and Prevention, American Diabetes Association

Common symptoms include:

- Increased thirst – excess sugar in your bloodstream causes fluid to be pulled from your tissues. Hence, you become thirsty.

- Frequent urination – as a result of increased fluid intake, you urinate more often.

- Hunger – if insulin is not present to transport sugar to your cells, your muscles and organs become depleted of energy. This causes hunger.

- Weight loss – your body’s inability to metabolize glucose will cause it to use alternative energy sources, stored in fat and muscle.

- Fatigue – if your cells do not have sugar, you will feel tired and irritable.

- Blurred vision – elevated blood sugar may cause the body to pull fluid from your eyes, making it difficult to focus.

- You take a Glycated hemoglobin (A1C) test and the results read –

- A1C level of 6.5 percent or higher on two separate tests

- Note: result between 5.7 and 6.4 percent is considered prediabetes

- Indicates a high risk of developing diabetes

- If the A1C test is unavailable to you, other tests to diagnose type 2 diabetes include –

- Random blood sugar test

- Fasting blood sugar test

- Oral glucose tolerance test

- Medications

- Metformin

- Sulfonylureas

- Meglitinides

- Thiazolidinediones

- DPP-4 inhibitors

- GLP-1 receptor agonists

- SGLT2 inhibitors

- Insulin therapy

- Healthy Eating

- Vegetables

- Lean protein

- Fruits

- Cut refined carbohydrates and sugars

- Exercise

- 30 minutes aerobic exercise, fives times per week

- Stretching

- Strength training

- About 1 in 11 Americans have diabetes

- That equates to 30.3 million Americans with diabetes (!)

- Of those, 95% have Type 2 diabetes.

- 1 in 4 Americans who have diabetes don’t realize they do, and haven’t been diagnosed.

- Even so, there are 1.5 million Americans diagnosed with diabetes every year.

- The financial burden of diabetes is incredible.

- $245 billion dollars is the total cost associated with diabetes:

- $176 billion for direct medical costs

- $69 billion in reduced productivity

- $245 billion dollars is the total cost associated with diabetes:

- Those with type 2 diabetes have a 50% higher risk of death.

- Type 2 diabetics, on average, spend 50% more on prescription drugs.

8 Facts About Type 2 Diabetes And Life Insurance

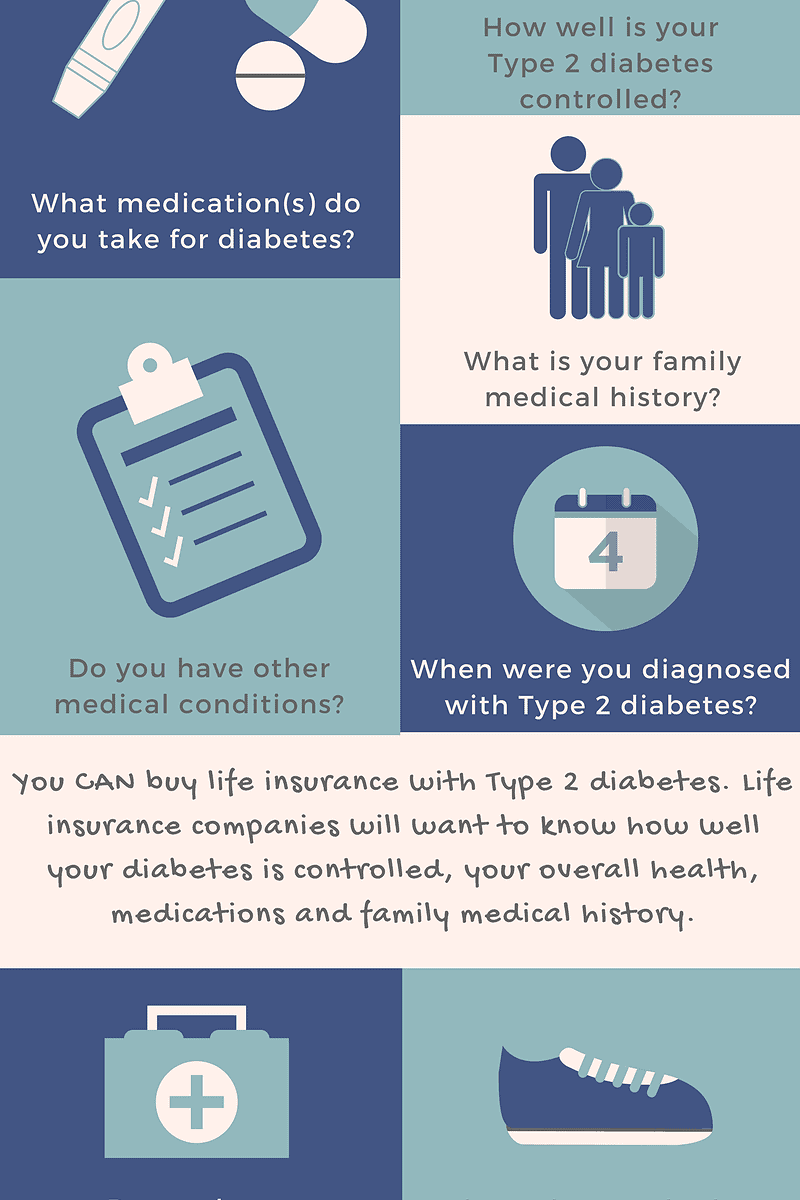

When you apply for life insurance, be prepared to communicate the following* –

*Really, the more proactive you are in communicating your experiences with type 2 diabetes, the better your odds are at securing the best rate you qualify for:

8 Facts (Questions) Life Insurance Companies Want To Know About Your Type 2 Diabetes:

- Type – to start, you will be asked about what type of diabetes you have.

- Good news – Type 2 diabetes is typically approved more often than Type 1. Why? Type 2 often has the ability to be controlled effectively through diet and exercise.

- Control – how well are you managing your type 2 diabetes? For example, what is your –

- A1C Levels

- Most underwriters like to see A1C at 7.5 or less

- Fasting Blood Sugar Level

- Ideally 135 or less

- Oral Glucose Test Results

- A1C Levels

- Medication – do you need a prescription(s) to treat your type 2 diabetes?

- If so, what kind and dosage? How often do you take the prescription?

- Family Medical History – are there health conditions that run in your family (close blood relatives)?

- Type 2 diabetes often runs in families.

- You will also be asked about a family history of:

- Cardiovascular disease

- Cancer

- Stroke

- Hypertension

- Other Medical Conditions – it’s common to experience other health problems with type 2 diabetes diagnosis. Underwriters will want to know if you have:

- Obesity

- Hypertension

- History of cancer

- History of stroke

- Depression

- Other serious medical condition

- Date of Diagnosis – you will be asked how old you were when you were diagnosed with type 2 diabetes.

- In general, the older you are at diagnosis, the better. Life insurance carriers prefer a diagnosis occurring after age 40.

- Regular Doctor Checkups – do you see your physician on a regular basis? This one is pretty important.

- Consistent doctor appointments is an indication of you proactively managing your type 2 diabetes.

- Responsibility is demonstrated.

- Underwriters will want to see records/lab work communicating a proactive medical plan.

- Consistent doctor appointments is an indication of you proactively managing your type 2 diabetes.

- Other Methods – what else are you doing to control your type 2 diabetes? For instance:

- Excerise

- Diet

- Stress reduction

Example Outcomes For Type 2 Diabetic Life Insurance Applicants

Life insurance companies are in the business of assessing risk.Here’s what we mean: During the application process, a life insurance underwriter evaluates how much money the company needs to charge the applicant based on the level of risk they pose.

Let’s look at a few example applicants to get a better understanding of the process:

- Johnny was diagnosed with type 2 diabetes at 52

- Applied for life insurance at 56

- His A1C levels hover around 6

- Condition is managed through diet

- He regularly exercises

- Non-tobacco

- Regularly visits his physician

- No other health conditions

- Joan was diagnosed with type 2 diabetes at 34

- Applied for life insurance at 42

- Her A1C levels hover around 7.5

- Condition is managed through Actos (a thiazolidinedione)

- Non-tobacco

- Regularly visits her physician

- No other health conditions

- Jay was diagnosed with type 2 diabetes at 27

- Applied for life insurance at 37

- His A1C levels around 10.0

- Condition is poorly managed with inconsistent insulin use

- Tobacco

- Does not follow-up with his physician

- Also diagnosed with obesity and hypertension

Key takeaway – life insurance options exist, regardless of how well-controlled your type 2 diabetes is.

Bottom Line (and How To Apply)

Truth – If a loved one depends on you financially, you need life insurance.It’s entirely possible to be approved for life insurance with type 2 diabetes. There’s a couple things you need to do in order to secure the best outcome:

- Partner with an independent agent – this is the most important first step.

- That way, you’ll receive multiple quotes from the top-rated life insurance carriers.

- Your best interest is at heart and your agent is not held captive to a particular life insurance company.

- Prepare – be ready to communicate your history with type 2 diabetes.

- List your physicians and their contact information.

- Communicate if you proactively manage your type 2 diabetes with diet and/or exercise.

- List all medications you have been prescribed.

- Understand your and your family’s medical history.

Or, simply fill our instant quote.

No comments:

Post a Comment